Credit Analysis & Research (CARE) has downgraded the rating of Punjab & Sind Bank to AA from AA+ for Rs 8.75 billion Lower Tier II Bonds.

The revision in rating reflects the continued deterioration in asset quality indicators along with weakened earnings profile of the bank. The asset quality is expected to further remain vulnerable on account of the bank's significant exposure to the power and infrastructure sector.

The revision in rating reflects the continued deterioration in asset quality indicators along with weakened earnings profile of the bank. The asset quality is expected to further remain vulnerable on account of the bank's significant exposure to the power and infrastructure sector.

The rating continues to be constrained by the relatively small size of operations and low CASA proportion of the bank. The rating, however, continues to take comfort from the majority ownership of the Government of India (GoI) and adequate capitalization levels of the bank.

Continued ownership and support from the Government of India and the bank's ability to improve its asset quality and sustain profitable operations are the key rating sensitivities.

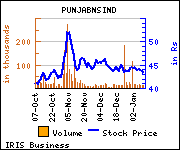

Shares of the company gained Rs 0.3, or 0.69%, to settle at Rs 43.60. The total volume of shares traded was 7,612 at the BSE (Tuesday).